Rethinking Risk: Building a Smarter Usage-Based Insurance Program for Commercial Fleets

In an industry with tight margins and high risk, usage-based insurance (UBI) is quickly becoming the standard in commercial fleet insurance. Rather than relying on static risk proxies like vehicle type or fleet size, UBI programs use real-world telematics data to inform underwriting, pricing, and loss control.

The result? An approach to commercial auto insurance that rewards safe driving, reduces claims, and empowers insurers to better manage risk exposure.

However, building a successful UBI program, especially for commercial fleets, is no small feat. From connecting to Electronic Logging Devices (ELDs) to making sense of disparate data formats, insurers face significant hurdles on the path to behavior-based underwriting. In this post, we’ll explore how insurers can build successful UBI programs and avoid common pitfals.

What is Usage-Based Insurance (UBI)?

UBI is a model where premiums are based on how, when, and how much a vehicle is driven, rather than on broad demographic or fleet-level data. This approach is powered by telematics devices, such as ELDs and GPS trackers, that collect data on driving behavior, mileage, vehicle location, and more.

In the commercial auto sector, UBI is particularly powerful. Fleets vary dramatically in how they operate, and traditional underwriting models struggle to reflect that complexity. UBI enables insurers to:

- Align premiums with risk: Reflects real-world driving patterns.

- Promotes safer driving: Encourages safer driving habits through incentives

- Identify high risk behaviors: Pinpoints outliers that drive claims

- Provides real-time visibility: Gain visibility into real-time fleet activity

_.jpg)

Why UBI matters for Commercial Fleet Insurance

Commercial fleets are under pressure to control costs, enhance safety, and ensure compliance. UBI offers a compelling solution for insurers and fleet operators by offering:

- Fleet diversity: No two fleets are alike. Telematics-based insurance allows for individualized risk profiles rather than blanket assumptions.

- Incentivized safety: Behavior-based underwriting models promote better driving through performance-based pricing and feedback.

- Claims efficiency: Real-time crash detection and mileage tracking streamline first notice of loss (FNOL) and post-incident reviews.

- Loss prevention: Detailed telematics data helps identify trends and root causes of accidents, supporting proactive risk mitigation.

With the regulatory tailwinds supporting ELD adoption and increasing digital maturity among fleets, UBI is no longer a future concept—it’s quickly becoming a necssity for competitive commercial auto insurers.

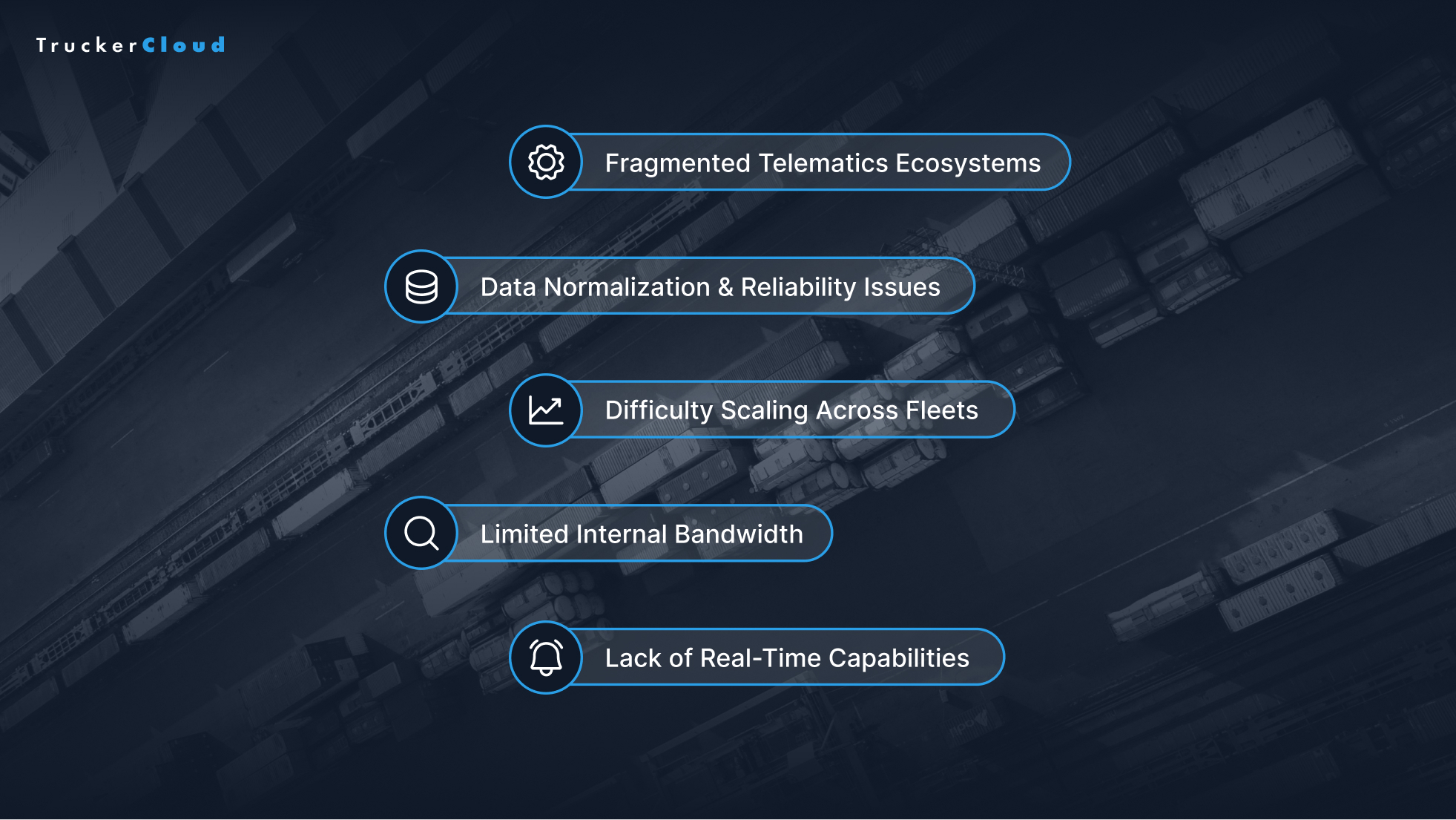

Challenges in Launching UBI Programs

Despite its potential, building a UBI program is fraught with technical and organizational complexity. Insurers often encounter these obstacles:

1. Fragmented Telematics Ecosystems

Fleets often use a wide variety of telematics vendors, requiring custom integrations with unique data formats, authentication protocols, and maintenance needs. Insurers end up spending months, and sometimes even years, just getting connected.

2. Data Normalization & Reliability Issues

Even when integrations are built, the data coming in is rarely plug-and-play. Mileage may be calculated differently across devices, timestamps may be missing, and VINs may be reported inconsistently. Without clean, structured data, underwriting decisions based on telematics are risky at best.

3. Scaling Difficulties

It’s one thing to pilot a UBI program with a small number of fleets using a single telematics provider. But scaling to thousands of insureds using dozens of different systems? That requires infrastructure that few carriers have internally.

4. Resource Constraints

Insurance carriers are not tech companies. Product, IT, underwriting, and claims teams are already stretched thin. Building and maintaining a telematics integration platform from scratch can divert valuable resources away from core business priorities.

5. Lack of Real-Time Capabilities

UBI thrives on immediacy. The ability to detect crashes, identify risky behavior, and update risk profiles in real time is what sets UBI apart. Legacy systems struggle to provide real-time data at the speed today’s insurers need.

What Makes a UBI Program Work?

To overcome these challenges, insurers need a strategic framework for building and scaling UBI programs. Here are the foundational elements that set successful programs apart:

Unified Telematics Integration

A robust UBI program starts with seamless access to telematics data. A platform that integrates with a wide range of ELDs, GPS systems, and dash cams enables:

- Quick fleet onboarding, often in days.

- Elimination of one-off integrations

- Consistent, normalized data across devices.

High-Fidelity Behavioral & Exposure Data

Quality data is the engine of UBI. Insurers need:

- Accurate mileage by VIN and geography

- Driver behavior insights (e.g., speeding, harsh braking)

- Crash detection and real-time FNOL

- Vehicle utilization trends

Data must be structured, time-stamped, and delivered in a format aligned with underwriting and claims workflows.

Insurance-Ready Dashboards & Workflows

Data is only valuable when it drives decisions. Insurance-ready dashboards should provide:

- Real-time exposure alerts.

- FNOL notifications.

- Behavioral scoring for risk assessment.

These tools empower insurers to act swiftly and confidently.

Flexible, Modular Program Design

One-size-fits-all doesn’t work in commercial auto. A successful UBI platform supports:

- Pay-how-you-drive (based on behavior)

- Pay-as-you-drive (based on mileage)

- Hybrid models tailored to specific fleet segments

Flexibility allows insurers to expand offerings and refine pricing.

See How TruckerCloud Powers Leading UBI Programs

At TruckerCloud, we make usage-based insurance work at scale. Our insurance-focused telematics data platform helps carriers launch and grow UBI programs without the technical burden.

We connect with 100+ ELDs and dash cams, normalizing fleet data in real time and delivering it through insurance-ready dashboards and APIs. That means you can:

- Launch UBI programs without custom integrations

- Ingest mileage, behavior, crash, and exposure data in real time

- Align pricing with actual risk and reduce premium leakage

- Enhance underwriting and streamline FNOL with structured insights

Want to see how TruckerCloud can help your team scale a smarter UBI program?

Book a demo and take the next step toward a faster, more data-driven future in commercial fleet insurance.