Commercial Auto's Profitability Problem — And Why Data-Driven Underwriting Is Now the Baseline

The commercial auto market isn’t just cycling through volatility — it’s undergoing a fundamental reset. As Carrier Management reported, the commercial auto liability segment posted a 113 combined ratio in 2024, marking 14 consecutive years of underwriting losses. Physical damage remains profitable, but liability headwinds — social inflation, litigation severity, and rising claim complexity — continue to drag down results.

For over a decade, many carriers tried to manage this environment with the same toolkit: static fleet schedules, loss runs, motor vehicle records, and manual audits. But today's exposure patterns and claim dynamics demand more. Legacy inputs are no longer enough to price risk or control losses with confidence.

The signal from the market is clear: durable performance in commercial auto requires real-time operational intelligence and behavioral data.

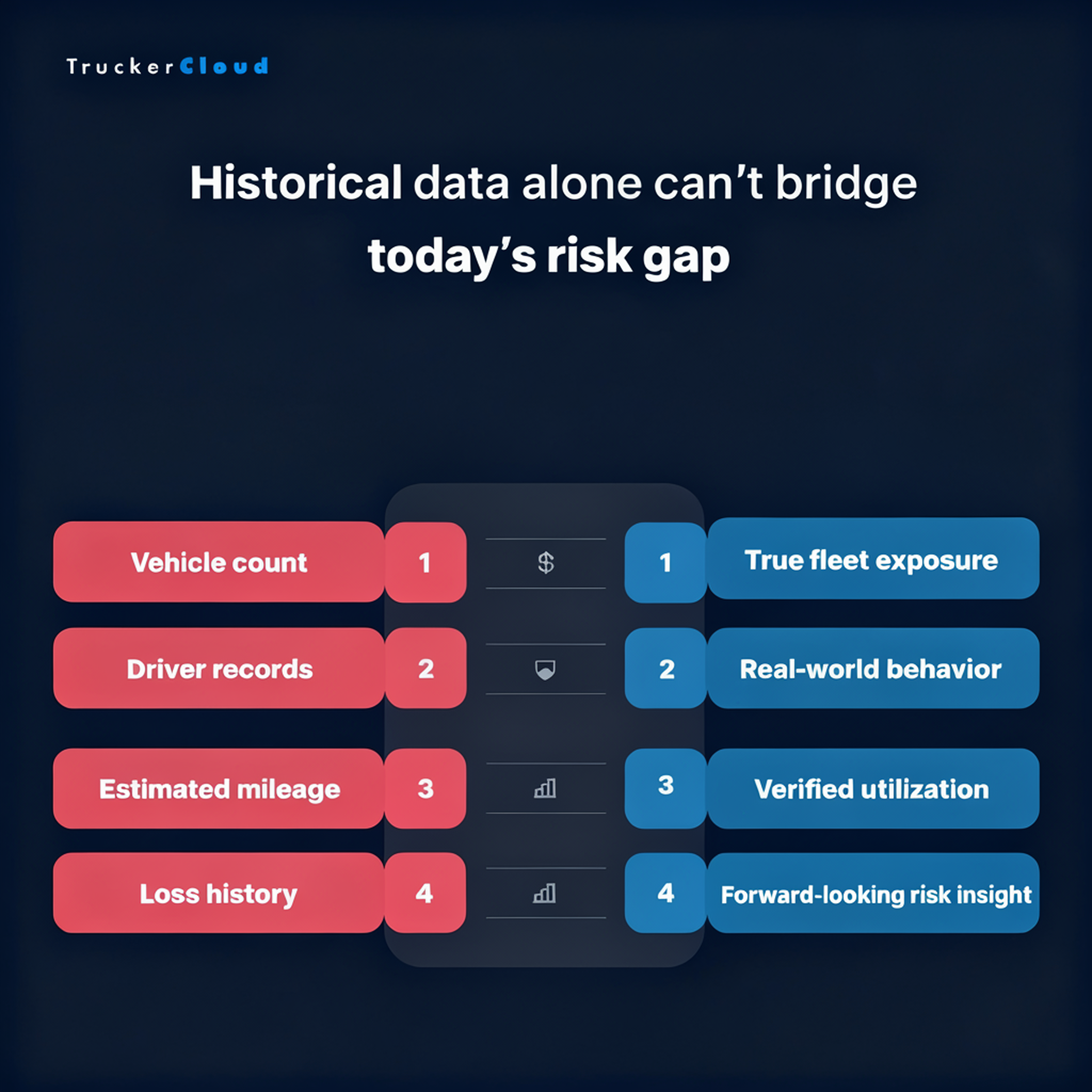

Historical data alone can’t bridge today’s risk gap

Carriers are increasingly recognizing the limits of traditional underwriting assumptions:

- Vehicle count ≠ true fleet exposure

- Driver records ≠ real-world behavior

- Estimated mileage ≠ verified utilization

- Loss history ≠ forward-looking risk insight

The result? Uncertainty in pricing, premium leakage, slower claims response, and limited ability to proactively influence risk.

Telematics is no longer optional — it's foundational

Telematics closes these gaps by delivering:

- Verified mileage and exposure data

- Actual asset activity and utilization

- Real-world driver behavior patterns

- Near-real-time event and incident signals

- Objective context for claims and loss control

With this visibility, insurers can segment more precisely, price more accurately, manage claims faster, and support safer fleets — all contributing to more stable portfolio performance.

This shift is already underway. Over the past three years, carriers have accelerated telematics-enabled programs, behavioral underwriting pilots, and modern FNOL initiatives. It’s no coincidence that TruckerCloud’s insurer partnership footprint has expanded significantly during the same period.

Telematics adoption isn’t aspirational anymore — it’s the new operating norm.

Where leading carriers are investing

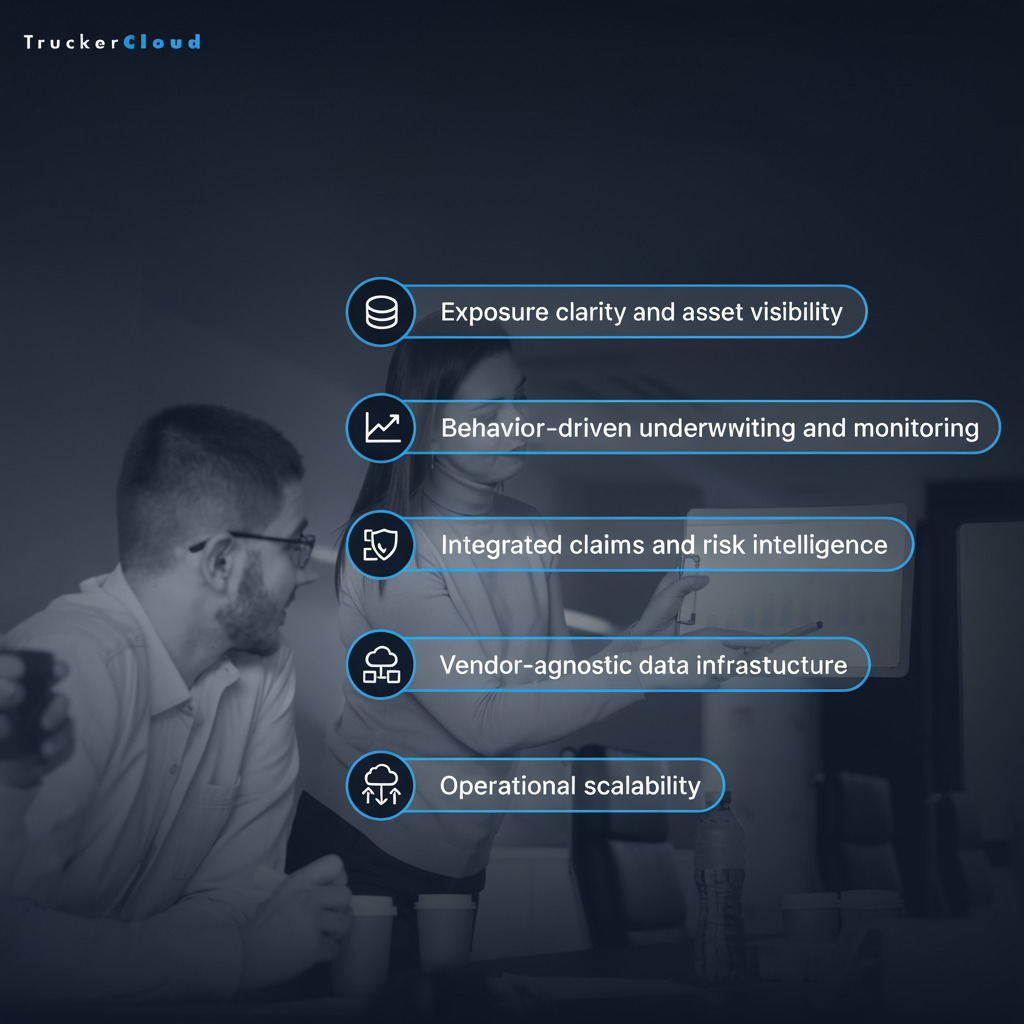

The insurers building competitive advantage today are focused on:

Exposure clarity and asset visibility

Real-time understanding of fleet composition and utilization to eliminate leakage and align premiums with exposure.

Behavior-driven underwriting and monitoring

Integrating speeding, braking, trip patterns, hours-of-service, and timing data into underwriting and pricing models.

Integrated claims and risk intelligence

Accelerating FNOL, improving incident verification, and enabling proactive safety interventions tied to real behavior.

Vendor-agnostic data infrastructure

Aggregating data seamlessly across telematics and camera providers — without forcing fleets to change systems.

Operational scalability

Frictionless onboarding and automated ingestion pipelines that produce clean, normalized data across underwriting and claims workflows.

In today's market, these aren’t forward-looking ambitions — they are fast becoming minimum standards.

How TruckerCloud drives the transition

TruckerCloud enables carriers to execute this shift without a heavy technical lift. With integrations across 100+ telematics and camera platforms and a purpose-built insurance data layer, we:

- Streamline access to verified fleet and behavioral data

- Reduce operational friction for carriers and fleets

- Equip underwriting, claims, and risk teams to act with clarity and speed

The result: stronger pricing integrity, better portfolio control, and improved loss performance — at scale.