Want to Launch an Insurance Telematics Program Without the Tech Headaches?

In today’s data-driven insurance landscape, launching a successful insurance telematics program can unlock several advantages, from sharper underwriting to fairer pricing models. But for many commercial auto insurers, a telematics program rollout is easier said than done.

The promise is big, but so are the technical hurdles: tangled integrations, inconsistent data feeds, and the sheer complexity of normalizing fleet telematics data from dozens of sources.

The result? Many insurance teams stall out before the program gets off the ground.

This guide breaks down what a telematics program requires behind the scenes, why traditional rollouts often fail, and how to build a scalable, effective program without overloading your tech team.

What is a Telematics Program?

At its core, a telematics program is a system that uses vehicle and driver data to inform insurance decisions. For commercial auto insurers, this means pulling from sources like Electronic Logging Devices (ELDs) and onboard cameras to better assess risk, set premiums, and manage claims.

Telematics data has revolutionized usage-based insurance by moving risk assessment from static indicators (like ZIP code or fleet size) to dynamic, real-world insights. Some examples include:

- Driver behavior data (speeding, harsh braking, idling, etc.)

- Real-time mileage by zone or VIN

- Crash detection and real-time FNOL

- Route history and exposure analysis

However, building a telematics program that actually delivers value requires more than connecting to a single device. Most fleets use multiple ELD or camera providers, and few insurers have the internal infrastructure to manage all that incoming data.

Why Most Telematics Program Rollouts Stall

Many insurers begin their telematics journey with high hopes but quickly realize how complex implementation. Between connecting to dozens of ELD providers and handling messy or incomplete data, the process can feel overwhelming before it even begins. Without the right strategy, these early-stage challenges often stall progress and limit long-term impact.

1. Integration is Time-Consuming & Resource-Intensive

Insurers looking to ingest telematics data typically need to set up API connections with each individual device or fleet platform their customers use. That means:

- Technical negotiations with ELD and camera vendors

- Custom integration buildouts for every provider

- Ongoing support and maintenance for each connection

For even a modestly sized carrier, this could mean dozens of integrations just to launch.

2. Data Quality Varies Wildly

Not all telematics data is created equal. Some ELDs offer rich behavioral analytics; others provide only basic mileage. Insurers often find themselves flooded with inconsistent data that their systems can’t parse or apply effectively.

3. Internal Teams Get Overwhelmed

Telematics data spans IT, data science, underwriting, claims, and product teams. Without a strong internal champion or cross-functional coordination, programs often fizzle. A key issues is that many insurers try to build and run the program with existing staff and infrastructure that weren’t designed for it.

4. It’s Hard to Show Early ROI

Launching a telematics program is a long-term effort. But without early wins, it’s hard to maintain buy-in. Many carriers struggle to:

- Prove underwriting improvements

- Demonstrate savings through reduced claim cycle times

- Visualize exposure reduction from better fleet visibility

What a Scalable Insurance Telematics Program Really Needs

Instead of chasing dozens of one-off integrations, modern insurers are taking a more strategic, platform-driven approach to telematics. Here's what that entails:

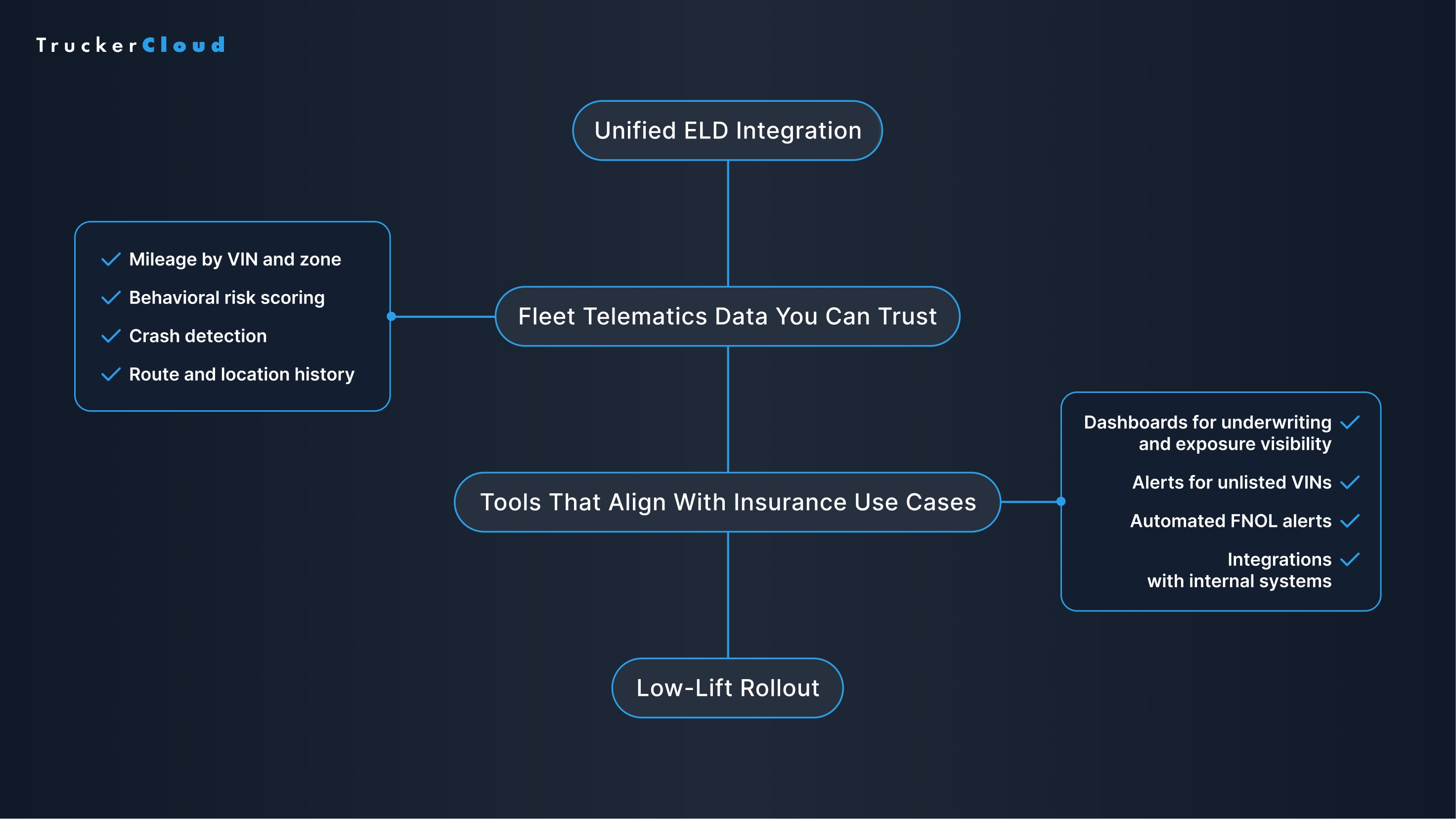

Unified ELD Integration

The first step is solving ELD integration at scale. That means partnering with a solution that connects to hundreds of devices out of the box, eliminating the need to build and manage custom integrations one-by-one.

A unified integration layer also normalizes data formats, so mileage from Provider A matches Provider B. This allows insurers to focus on insights rather than plumbing.

Fleet Telematics Data You Can Trust

Scalability isn't just about volume—it's about quality. Your data pipeline should surface high-fidelity telematics signals for core insurance workflows, such as:

- Mileage by VIN and zone for exposure tracking

- Behavioral risk scoring for underwriting

- Crash detection for real-time FNOL

- Route and location history for claims and loss control

When this data is structured, verified, and centralized, it becomes a true asset to your insurance tech stack.

Tools That Align With Insurance Use Cases

Fleet data alone isn't enough. Insurers need tools designed for their workflows, not just raw data dumps. That includes:

- Dashboards for underwriting and exposure visibility

- Alerts for unlisted VINs (to reduce premium leakage)

- Automated FNOL alerts to start the claims process instantly

- Integrations with internal systems (policy, claims, loss control)

Low-Lift Rollout

The best telematics programs don’t take a year to launch. They’re built on top of existing integrations and infrastructure, enabling implementation in weeks, not quarters. This accelerated timeline gives insurers an edge: They can extend telematics offerings to more fleets sooner, expanding their reach and value.

At the same time, early access to real-time crash alerts, mileage data, and exposure validation provides immediate returns, building internal momentum and demonstrating ROI. Over time, these wins pave the way for sophisticated usage-based insurance models--without overhauling your entire tech stack from day one.

Where TruckerCloud Fits In

At TruckerCloud, we help commercial auto insurers launch and scale telematics programs without the tech headaches.

Our insurance data platform integrates with over 100 ELDs, cameras, and telematics providers, giving you instant access to the data you need without custom buildouts.

Key features include:

- A unified connection layer for your insureds’ telematics devices

- Normalized fleet data delivered in real time

- FNOL alerts, mileage tracking, and behavioral insights

- Dashboards and tools built specifically for insurance workflows

Ready to build a telematics program that delivers results without overwhelming your team?

Book a demo to see how TruckerCloud can help you launch smarter, scale faster, and unlock the power of real-time fleet data.